Drift's lending pools work similarly to the lending pools of Aave.

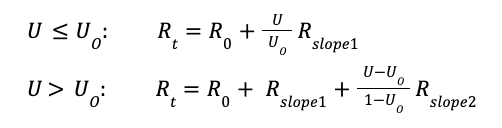

Each market has an optimal borrow rate and max borrow rate and uses this piecewise function based on the Utilisation Rate (*U**)*.

The Utilisation Rate represents the availability of capital within the system.

-

If _U _is high -- there is abundant capital within the system and the protocol users are given incentives in the form of low-interest rates to encourage borrowing;

-

If U is low -- capital within the system is scarce and the protocol will increase interest rates to incentivise more capital supply and repayment of debt.

Note: this model has been adapted from Aave's interest rate model. The parameters and model will be iterated and improved as Drift's borrow lend engine grows. Last Updated: 21 October 2022.

The interest rate is based on the borrow utilisation.

Liquidity risk materialises when utilisation is high and this becomes more problematic as _U _gets closer to 100%.

To tailor the model to this constraint, the interest rate curve is split into two parts around an optimal utilisation rate Uo. Before _Uo _the slope is small, after it begins rising sharply.

The interest rate (InterestRate) model:

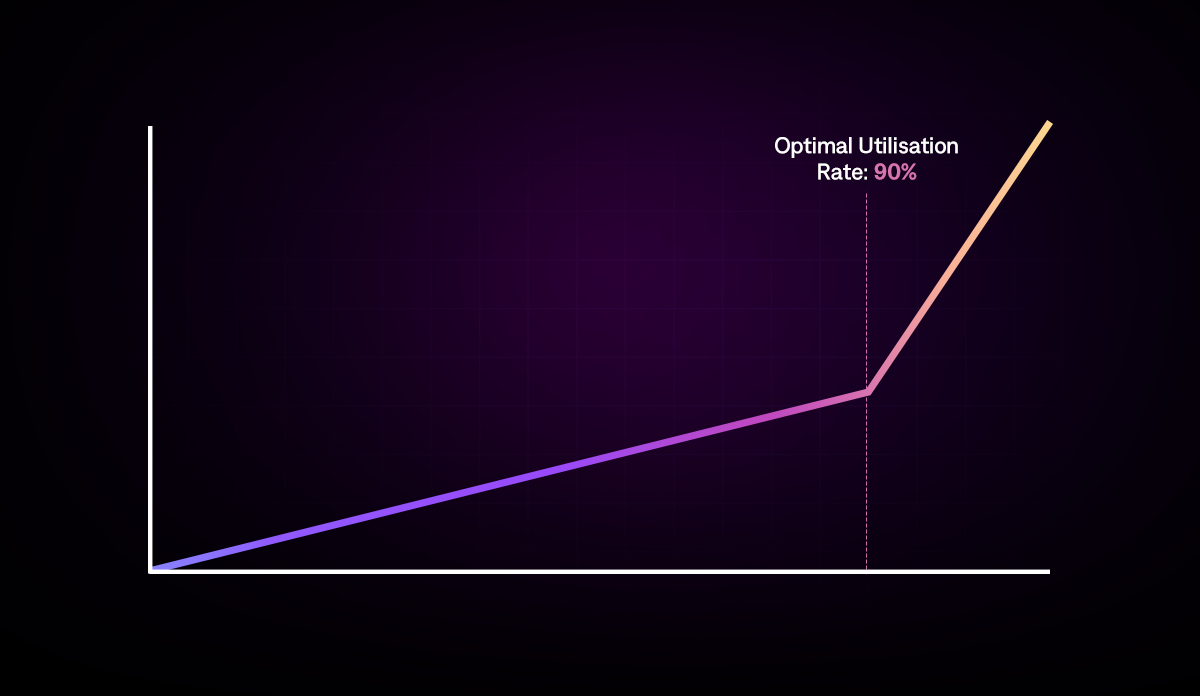

The resulting model produces the following graph: